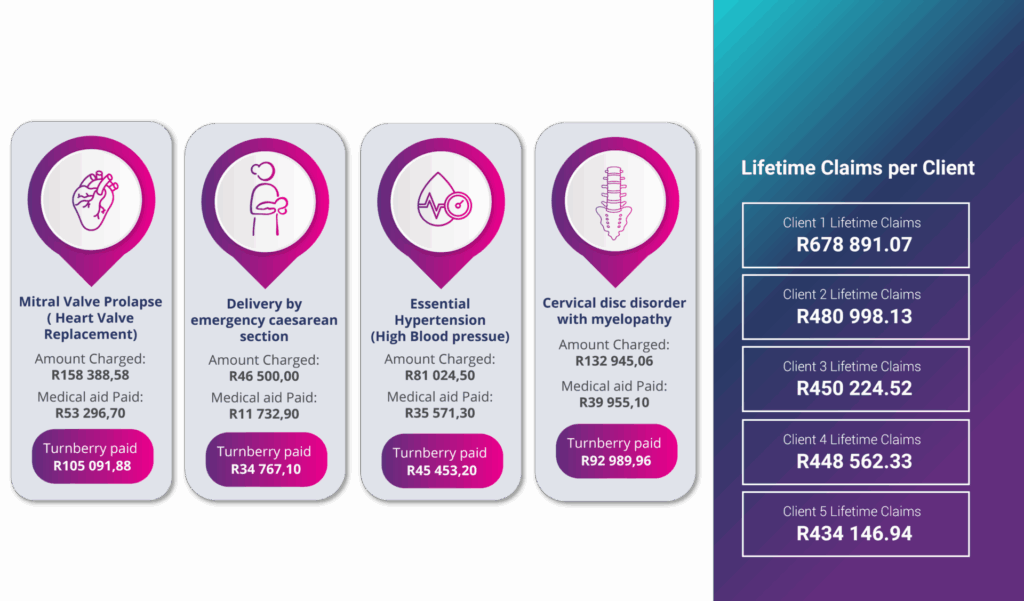

Medical aid alone is no longer enough to fully protect you from the rising costs of healthcare. Doctors may charge more than medical aid rates, and hospitals can impose co-payments or fees not covered by your plan—leaving you with significant out-of-pocket expenses.

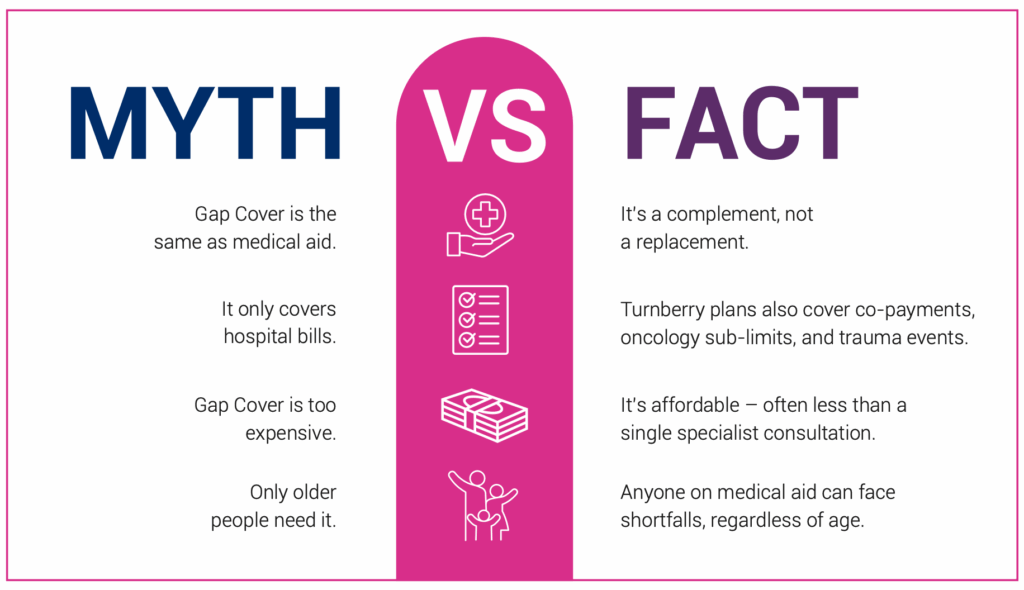

Gap Cover is a short-term insurance product designed to cover these medical expense shortfalls. As medical schemes introduce more cost-containment measures—such as co-payments and provider network restrictions—Gap Cover plays a vital role in ensuring your financial protection.

Regardless of your age or health, unforeseen medical events can happen. Having Gap Cover in place provides critical support during life’s unexpected moments, helping you safeguard your financial wellbeing while accessing the care you need.

At Turnberry, our mission is to offer clients security and assurance—especially when it

matters most.

Note: The South African Value-Added Tax (VAT) rate will increase from 15% to 15.5%, effective from 1 May 2025. As this is essential to ensure compliance with this regulatory change, we are in the process of updating our premiums to align to this increase.

National Treasury annually publishes new limits under the Demarcation Regulations. As of 1 April 2024, the limit for medical expense shortfall (Gap) policies has been increased from R198,660.43 to R219 845.96. Turnberry has increased the overall annual limit on all policies we administer with these benefits, with effect from 1 April 2024. Our clients automatically qualify for the adjusted overall annual limit.

DYNAMIC is designed for a new generation of healthcare consumers – smart, proactive, and on the move. Tailored for young professionals and couples starting out, this Gap Cover solution offers flexible, affordable protection from costly medical shortfalls. With a focus on simplicity, value, and peace of mind, DYNAMIC helps you confidently navigate your healthcare journey—knowing you’re covered when it counts most.

Med-Extend has been designed to assist clients with medical expense shortfalls for Specialists and with covering Defined Procedures that have been excluded on their specific Medical Scheme option.

At Turnberry, we understand that peace of mind in healthcare comes from more than just having medical aid — it comes from knowing that when unexpected medical expense shortfalls arise, you are fully supported. That’s why our Gap Cover solutions are designed with unique benefits that go beyond the standard, giving both brokers and clients confidence in every moment of care.

From specialised product enhancements to service excellence and personalised broker support, Turnberry’s benefits are built to protect, support, and guide you through life’s medical challenges. Whether it’s covering high specialist costs, reducing financial stress, or ensuring a seamless claims process, our difference lies in the extra value we bring to every policyholder and broker partnership.

With Turnberry, you’re not just covered — you’re cared for.

MRI and CT Scan Cover

Casualty benefits for Accidents

Casualty Benefit for Illness

Critical Illness Benefit

First Diagnosis of Cancer

Innovative Cancer Cover

Robotic Surgery Cover

Access to International Travel Insurance

Medical Expense Shortfall Cover includes cover for: Specialists, Basic and specialised Radiology, Physiotherapy, Consumables (e.g. plasters, cotton wool etc), Pathology, Prescribed Minimum Benefits

Our packages start from R185 / Family / Month. Please get in touch with us for more information.

Co-Payment Cover

A co-payment or deductible is an upfront amount that needs to be paid before undergoing certain procedures, as specified by your Medical Scheme.

When you experience a co-payment for a procedure or scan (as specified by your Medical Scheme) you would need to pay for the

co-payment up-front and then claim the amount back from your Turnberry Policy (provided that the plan you selected offers co-payment cover).

Non DSP Hospital Cover

Should you choose to go to a hospital or day clinic outside of your Medical Scheme’s Hospital Network/ Designated Service Providers, you would be liable for a portion of the account, as specified by your Medical Scheme.

Example: Henry’s Medical Scheme stipulates that he needs to go to hospital X, if he chooses to go to another hospital he would need to pay the first R8 700 of the hospital account. Henry chooses to go to hospital Y and pays the R8 700 and then claims it back from his Turnberry Premier Policy.

It’s cover for medical expense shortfalls your medical aid doesn’t fully pay.

Yes. Medical aids cover at set tariffs, while specialists often charge more. Gap Cover bridges this gap.

Any medical aid member in South Africa – individuals or families.

Premiums are affordable and vary depending on your chosen plan.

Simply submit your medical aid statement and invoices on the Claim form provided on Turnberry’s website, under documents . You can also submit via our digital online claim form on – https://turnberry.co.za/claim-

Yes. Family options are available for spouses and dependents under one premium.

If you have been on your existing Gap Cover policy for 3 months or longer and have not had a break in membership then reduced waiting periods will apply. Upon acceptance of your application a policy document will be sent to you, which will advise you of your reduced waiting periods.

Yes you can transfer your Gap Cover policy to Turnberry. In order to do so please complete a Turnberry application form and submit it with your existing Gap Cover policy document to Turnberry. Please note that you would be required to obtain financial advice from your Financial Advisor.

The baby will be covered from date of birth under the Gap Cover policy. To initiate the cover for the baby the principle insured person needs to complete a dependent addition form. Please note, A newborn must be added onto the Policy within 90 days, from the date of birth, in order to avoid waiting periods. If an older child or adult dependent is added, the addition of the new member will be subject to waiting periods. Once the baby or new dependent is added, an amended Policy Document will be issued as confirmation of the change.